Repurchasing of own shares

Second trading line on SIX Swiss Exchange Ltd

Biel/Bienne (Switzerland), 3 February, 2016 – The Swatch Group intends to repurchase own shares up to a maximum value of CHF 1 billion for a later reduction of capital or for other purposes.

Swatch Group repurchases the shares for a reduction of capital or to hold them as treasury shares for at least six years starting from the repurchase date. At the end of a period of six years, Swatch Group has the option, apart from a reduction of capital, to use the shares for acquisitions, equity-linked transactions, for other purposes or to resell the shares. The repurchase of shares will start on 5 February 2016 and will last until 4 February 2019 at the latest.

The volume of repurchased shares of a maximum of CHF 1 billion will be half on bearer and half on registered shares. The repurchase of bearer respectively registered shares will take place on SIX Swiss Exchange Ltd on a second trading line each, established solely for this purpose.

The Swiss federal withholding tax will be applied to shares repurchased via second trading line at a rate of 35% computed on the difference between the repurchase price and its nominal value.

Related news

Half-Year Report 2025

Net sales of CHF 3 059 million, -7.1% against the previous year at constant exchange rates and on a comparable basis1) (-10.4% at current rates). Negative currency impact of CHF -113 million. Operating profit of CHF 68 million (previous year: CHF 204 million). Operating margin of 2.2% (previous year: 5.9%). Net income of CHF 17 million (…

Apprenticeship graduation

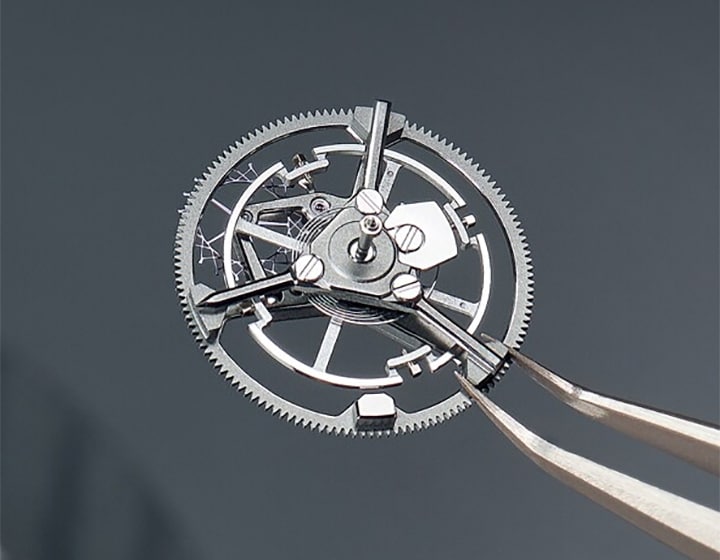

Congratulations to our apprentices for their successful apprenticeship graduation! The companies and brands of the Swatch Group Blancpain, CHH Microtechnique, Comadur, Dress your body, EM Microelectronic-Marin, ETA, Glashütte Original, Longines, Manufacture Ruedin, Montres Breguet, Nicolas G. Hayek Watchmaking School Pforzheim, Nivarox-FAR, Omega…

Message from the Chair

Message of Nayla Hayek, Chair of the Swatch Group Board of Directors, on the occasion of the Annual General Meeting of May 21, 2025, in Biel (BE), Switzerland. The original spoken text (in German) is valid. Sehr geehrte Damen und HerrenLiebe Mitaktionärinnen und Mitaktionäre Sie haben ja sicherlich alle unseren Jahresbericht mit meinem Geleitwort…