Statement

Biel / Bienne (Switzerland), October 27, 2016

Based on the amicable settlement between Swatch Group and the Competition Commission (Comco), which was signed in 2013, the company ETA has a supply obligation towards third-party customers until the end of 2019. The supply quantity agreed upon has - by a substantial amount – not been purchased by these third-party customers, and certain major customers did not place any orders for 2017, while ETA, due to its imposed supply obligation, must continue to maintain the capacity to deliver roughly 1.5 million mechanical movements. Therefore, Swatch Group requested from Comco that ETA should be allowed to offer and sell the non-purchased quantities to all its third-party customers. The Swatch Group proposal never intended to deviate from the amicable settlement but rather to supplement it in order to take the abusive customer behavior into account. This request has been rejected by Comco.

Swatch Group regrets Comco’s decision and deems it utterly unrealistic. Swatch Group is forced to maintain the production capacities for third-party customers – with substantial financial and personnel expenditures – although in some cases, the third-party customers have drastically reduced or even completely dropped their order quantities. With this decision, ETA and Swatch Group must once again assume their customers’ economic risk. In spite of the fact that major customers such as Sellita or Tudor have reduced their order quantities for 2017 by about 700,000 pieces in total relative to the previous year and although the difference between the effectively-ordered quantities and the spare capacity amounts to almost 900,000 pieces, ETA must maintain the determined capacities for the coming years in order to meet its supply obligation as defined by Comco. As a result, the decision of the Comco penalizes a market participant – ETA – which has made substantial investments in innovation and development of industrial capacity, while other market participants again preferred to focus their investments solely on marketing their products. In order to cover the additional costs arising from this enforced readiness to deliver, ETA will have to consider massive price hikes.

The Swatch Group Ltd

Related news

Half-Year Report 2025

Net sales of CHF 3 059 million, -7.1% against the previous year at constant exchange rates and on a comparable basis1) (-10.4% at current rates). Negative currency impact of CHF -113 million. Operating profit of CHF 68 million (previous year: CHF 204 million). Operating margin of 2.2% (previous year: 5.9%). Net income of CHF 17 million (…

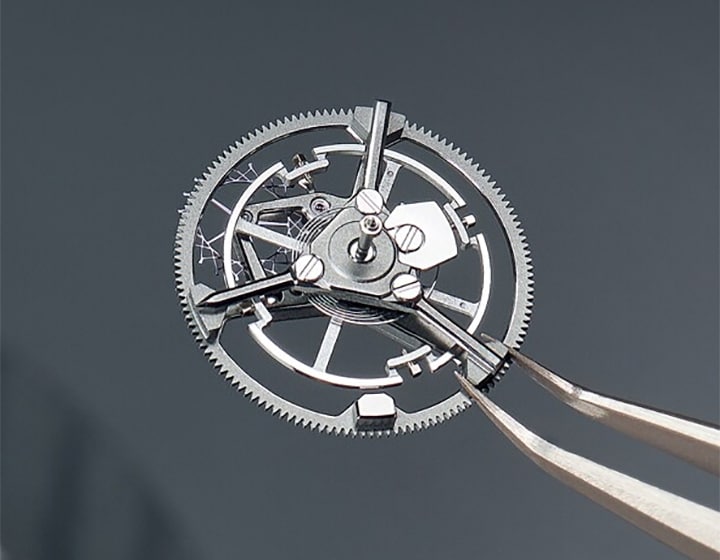

Apprenticeship graduation

Congratulations to our apprentices for their successful apprenticeship graduation! The companies and brands of the Swatch Group Blancpain, CHH Microtechnique, Comadur, Dress your body, EM Microelectronic-Marin, ETA, Glashütte Original, Longines, Manufacture Ruedin, Montres Breguet, Nicolas G. Hayek Watchmaking School Pforzheim, Nivarox-FAR, Omega…

Message from the Chair

Message of Nayla Hayek, Chair of the Swatch Group Board of Directors, on the occasion of the Annual General Meeting of May 21, 2025, in Biel (BE), Switzerland. The original spoken text (in German) is valid. Sehr geehrte Damen und HerrenLiebe Mitaktionärinnen und Mitaktionäre Sie haben ja sicherlich alle unseren Jahresbericht mit meinem Geleitwort…